Featured

- Get link

- X

- Other Apps

Chase Customers: Key Insights Into Their Latest Zelle Policy Changes

Customers using Zelle through Chase will soon face a new policy to remember. Starting from March 23, 2025, JPMorgan Chase might block certain Zelle payments If these scams are believed to have emerged from social media, then this represents the bank's effort to shield its clients from fraudulent activities that have caused significant financial harm so far.

Luckily, Chase provides numerous alternative methods for digital transactions. Below is the information you should be aware of.

Read more: Scamming the Scammers: Meet the Deepfake Granny, Digital Bots and YouTubers Fighting AI Fraud

Why Chase plans to block social media fees for Zelle transactions?

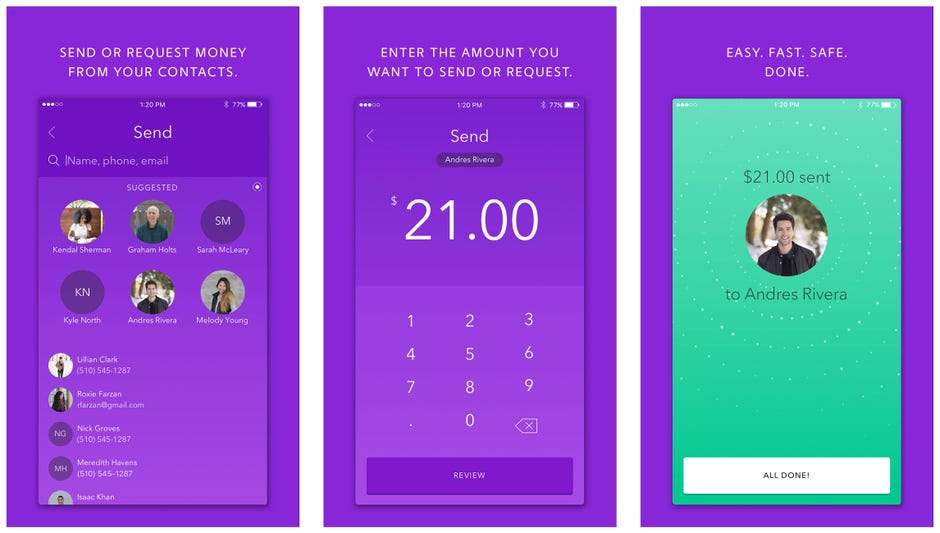

Zelle and other digital payment apps , like Venmo and Cash App, simplify transactions for scammers To obtain their funds, numerous scammers focus on individuals via social media platforms. As reported by Chase , approximately half of the fraud reports it received between June 1, 2024, and December 31, 2024, originated from social media platforms.

A December 2024 lawsuit according to allegations made by the Consumer Financial Protection Bureau, clients at JPMorgan Chase, Bank of America, and Wells Fargo have suffered losses exceeding $870 million via Zelle transactions since the service was introduced in 2017. The CFPB has recently brought this issue into light. dropped the suit Still, this has triggered concerns that users are vulnerable when utilizing the digital payment app. Additionally, since Zelle does not provide any purchase protection, once funds have been transferred via the app, it is highly improbable that you will recover your money.

Through its new policy, Chase aims to prevent fraud before it occurs. Zelle Service Agreement Will permit it to be declined or blocked if payments appear to originate from social media platforms. The bank might also postpone or place holds on transactions to ask for additional verification, including confirming your identification, the identities of the payer or payee, along with specific payment details.

Top Digital Wallets and Payment Applications: See at NewsBlogAlternative secure methods for Chase clients to transfer funds

If you wish to transfer funds into or out of your Chase account, numerous secure methods are available. Chase collaborates with multiple entities for this purpose. other digital payment services , such as PayPal , Apple Pay , Google Pay , Samsung Pay and Paze.

Never transfer funds via a payment app to individuals you aren't familiar with and do not trust. Additionally, ensure you have knowledge of the individual involved. signs of a scam So you can steer clear of fraudster pitfalls.

- Get link

- X

- Other Apps

Popular Posts

Unmasking Misinformation: Journalist’s Quest for Verified Truth (International Edition)

- Get link

- X

- Other Apps

PTA Clarifies: X Disruption (Formerly Twitter) Unrelated to Local Internet Filtering – International Edition

- Get link

- X

- Other Apps

Comments

Post a Comment