Featured

- Get link

- X

- Other Apps

Burying Billions: How Secret Hoards Cost Portugal Millions Over a Decade

Burying money is the main reason why, over the last decade, the Bank of Portugal has had to replace 317,000 damaged banknotes worth around €13.8 million that have been handed in by people who want to recover their value.

"The notes are ruined by humidity and most of them are ruined by people burying the notes in the ground. And then the humidity of the earth plus insects cause the banknote to deteriorate," José Luís Ferreira, coordinator of Banco de Portugal's cash operational area, told Euronews.

Even though it is usually concealed, human ingenuity in hiding funds has no limits. People have been known to stash their money in microwaves, fireplaces, or even septic tanks.

For José Luís Ferreira, this behavior might stem from distrust towards financial institutions or serve as a means to ensure liquidity during unexpected circumstances.

"Individuals believe that concealing cash bills will safeguard their personal possessions against stealing and various natural disasters. This belief remains particularly prevalent amongst those with limited education," he explains.

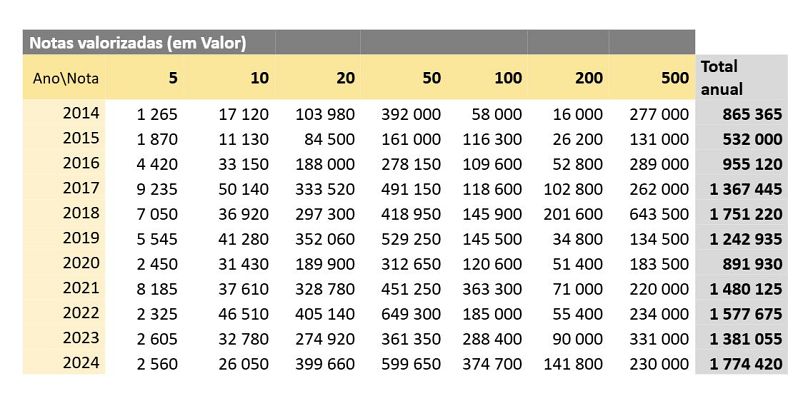

In 2024 alone, more than 40,000 banknotes were valued, mainly €20 notes (19,983) and €50 notes (11,993), totalling more than €1.7 million, the highest value since 2014.

The framework governing cash flow in Portugal influences how individuals accumulate their savings and choose their means of storing wealth.

This is evident by the number of €20 notes that have increased in value.

Regarding the €50 note, "this might be explained by the preference of individuals to keep their wealth stored in higher denominations, thereby minimizing the storage space required," clarifies the head of the central bank’s cash operations division.

The pandemic led to an increase in hidden money.

In 2014, the peak year for turned-in banknotes saw a significant spike in 2022, totaling 40,954 notes (worth approximately €1.5 million). This surge can be attributed primarily to the effects of the COVID-19 pandemic, which led to an increase in hoarding behavior.

After the pandemic ended, individuals with items kept at home that had degraded chose to go to the Bank of Portugal for an exchange.

José Luís Ferreira recalls 2018 as a high point for banknote retrieval services, largely because of the devastating fires that occurred towards the close of 2017. In that period, approximately 32,000 banknotes were retrieved, amounting to a total value of €1,751,220.

One of the situations, describes the head of the Bank of Portugal, was that the owner of a wood sawmill in the centre of the country, who depended on the money in a safe to pay his workers' wages, caught fire. 40,000 euros were at stake.

What process is followed when evaluating banknotes?

The criteria for valuing banknotes are standardised at a Eurozone level. This means that all the central banks of the countries that have joined the euro are obliged to fulfil the same criteria.

"The fragments that make up a banknote must add up to more than 50% of the banknote. And these fragments have to make it possible to identify that they belong to genuine banknotes. It is in these fragments that our technicians, who are prepared and use specific equipment for this purpose, can look for the security elements that allow them to assess whether that fragment is part of a genuine banknote or not," explains José Luís Ferreira.

To do this, the team of technicians relies on the help of software developed in Portugal that quickly analyses the size of the piece of banknote handed over in relation to the total surface area. The device is able to add up several fragments and find out what percentage of the banknote is left.

In order for the amount to be returned, it is also necessary to prove that the reason for the poor condition of the money corresponds to the description of the person who handed it in, since in the case of fraud there may be no refund.

There are also those who try to deceive the technicians in order to make some money through forgeries. If it turns out that the notes are not genuine, the information is passed on to the relevant authorities and the money is seized.

"We've often received letterheads here, some more sophisticated, others less so, claiming that they were notes that had been damaged, trying to mask the forgery or counterfeiting in the deterioration of the note. But it's difficult for them to pass through our processes. They are very robust control processes and I can guarantee, with complete certainty, that we manage to isolate and filter out all these attempts to deceive the bank into paying the notes," assures the coordinator of Banco de Portugal's cash operational area.

- Get link

- X

- Other Apps

Popular Posts

Unmasking Misinformation: Journalist’s Quest for Verified Truth (International Edition)

- Get link

- X

- Other Apps

PTA Clarifies: X Disruption (Formerly Twitter) Unrelated to Local Internet Filtering – International Edition

- Get link

- X

- Other Apps

Comments

Post a Comment